The health crisis we face as a country has led businesses all over the nation to reduce or discontinue their services altogether. This pause in the economy has greatly impacted the workforce and as a result, many people have been laid off or furloughed. Naturally, that would lead many to believe we might see a rush of foreclosures like we saw in 2008. The market today, however, is very different from 2008.

The concern of more foreclosures based on those that are out of work is one that we need to understand fully. There are two reasons we won’t see a rush of foreclosures this fall: forbearance extension options and strong homeowner equity.

1. Forbearance Extension

Forbearance, according to the Consumer Financial Protection Bureau (CFPB), is “when your mortgage servicer or lender allows you to temporarily pay your mortgage at a lower payment or pause paying your mortgage.” This is an option for those who need immediate relief. In today’s economy, the CFPB has given homeowners a way to extend their forbearance, which will greatly assist those families who need it at this critical time.

Under the CARES Act, the CFPB notes:

“If you experience financial hardship due to the coronavirus pandemic, you have a right to request and obtain a forbearance for up to 180 days. You also have the right to request and obtain an extension for up to another 180 days (for a total of up to 360 days).”

2. Strong Homeowner Equity

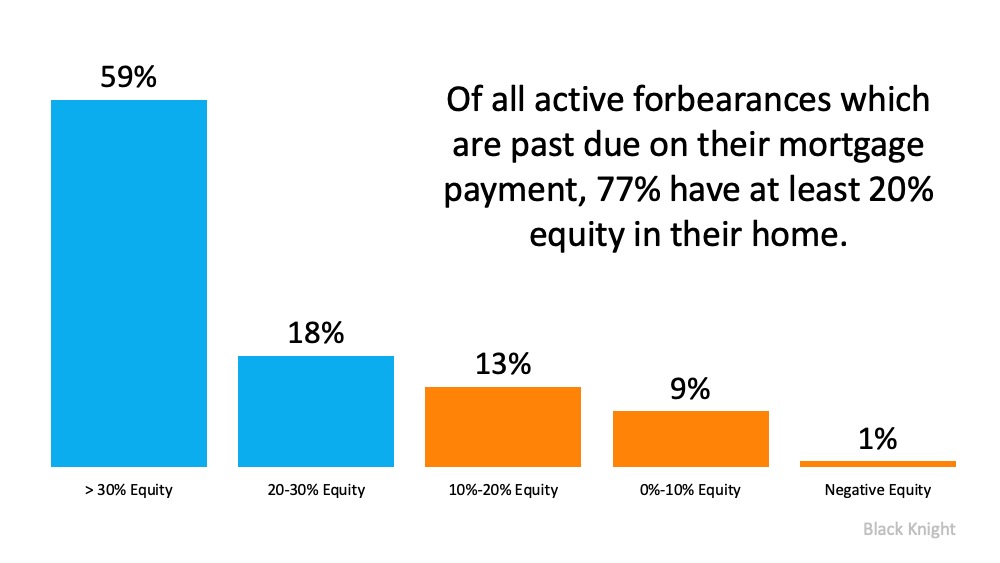

Equity is also working in favor of today’s homeowners. This savings is another reason why we won’t see substantial foreclosures in the near future. Today’s homeowners who are in forbearance actually have more equity in their homes than what the market experienced in 2008.

The Mortgage Monitor report from Black Knight indicates that of all active forbearances which are past due on their mortgage payment, 77% have at least 20% equity in their homes (See graph below): Black Knight notes:

Black Knight notes:

“The high level of equity provides options for homeowners, policymakers, mortgage investors and servicers in helping to avoid downstream foreclosure activity and default-related losses.”

Bottom Line

Many think we may see a rush of foreclosures this fall, but the facts just don’t add up in this case. Today’s real estate market is very different from 2008 when we saw many homeowners walk away when they owed more than their homes were worth. This time, equity is stronger and plans are in place to help those affected weather the storm.

#5StarREALTOR®, #FixandFlip, #RealEstateInvestor,

- TOPIC: Home Selling

- LOCATION:

- California Ventura County

Blog Archive

Blog Archive

No comments:

Post a Comment