My Los

Angeles County Real Estate BLOG My Ventura County Real Estate BLOG

Investor Fix & Flip-Bidding Ends SOON! #ChrisBJohnsonRealtor

Investor Fix & Flip-Bidding Ends SOON! #ChrisBJohnsonRealtor

Last year we saw headlines about a possible housing market bubble, and many wondered if Americans still felt confident about the value of their homes. Recently, the 2018 Houzz & Home Study revealed:

“Homeowners with mortgages have seen their home equity more than double since 2011, increasing to a record-setting $8.3 trillion in 2017.”

The average homeowner gained $16,200 in home equity between Q2 2017 and Q2 2018 according to the latest release of CoreLogic’s Home Equity Report.

Since 2011 home values have increased significantly throughout the country, with prices rising by 5.1% in 2018 alone. When surveyed, homeowners revealed the top four reasons why they felt their homes had increased in value.

- Desirable Location

- Improved National Economy

- Improved Local Economy

- Low Home Inventory in My Area

As we can see, not only does the data show that the homes have appreciated, but homeowners also believe they know why. Many have taken advantage of the opportunity to use their newly found equity to sell their current house and move up to their dream home!

2019 will be a good year for the homeowners that still want to take advantage of their home equity! CoreLogic forecasts that home prices will increase by 4.8% by the end of the year.

Bottom Line

If you are a homeowner who would like to find out your current home value, let’s get together to discuss the hidden opportunities in your home!

#SellYourHomeForMoreandPayLess #TimeToSell #ChrisBJohnsonRealtor #SellersPayZEROCommission #ListYourHome&PayNoCommission #BetterThanFSBO #5StarREALTOR®

Your home is probably the biggest asset you own. This is why you should hire a professional to guide you through all your real estate transactions. My goal is to help 24 to 28 families each year either buyor sell a home. I am NOT interested in Selling 100 or 200 homes a year because I would not be able to give each family the time, attention and energy they deserve.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

https://www.google.com/analytics/web/#home/a69066132w111663562p116541675/ #ChrisBJohnsonRealtor https://chrisbjohnsonrealtor.allisonjamesinc.com/ask/f3dbcb3921f86f5ee5557c696489bc96 5 Star Rated REALTOR #ChrisBJohnsonREALTOR https://youtu.be/p4-VfR1DJNA Sell Your Home For More and Pay Less Using A 5 Star Rated Realtor https://youtu.be/CRCXLh4EycU https://biteable.com/watch/sell-for-more-pay-less-chrisbjohnsonrealtor-1959786/afffdc699004f8b15891489c4de17b4cbd4e3a75 https://biteable.com/watch/xome-super-seller-1954842 https://www.ratemyagent.com/real-estate-agent/chris-b-johnson-xu316/reviews http://www.VCNeighborhoodValues.com http://www.ChrisBJohnsonRealtor.AllisonJamesInc.com/blog.php http://www.ChrisBJohnsonRealtor.AllisonJamesInc.com/ http://my.flexmls.com/ChrisBJohnsonRealtor IDX https://www.xome.com/auctions/agent-listings/Chris-Johnson/11009531 https://drive.google.com/file/d/0Bzia-m_p1JFMMVMzSGZFdmNYV28/view?usp=sharing http://www.simplifyingthemarket.com/?a=97822-26df5ea08f8689012df0225866ae0bf1 https://www.linkedin.com/today/author/chrisbjohnson https://www.linkedin.com/in/chrisbjohnson/detail/recent-activity/posts/ https://www.linkedin.com/pro/chrisbjohnson http://www.linkedin.com/in/chrisbjohnson https://activerain.com/profile/chrisbjohnson https://activerain.com/blogs/chrisbjohnson https://www.youtube.com/c/ChrisBJohnsonRealtor http://chrisbjohnsonrealtorluxuryhomes.blogspot.com/ http://www.google.com/+ChrisBJohnsonRealtor http://www.google.com/+ChrisBJohnsonRealtorMoorpark http://www.google.com/+ChrisbjohnsonrealtorMoorparkShortSaleRealtor https://moorpark-short-sale-specialist.business.site https://chris-b-johnson-realtor.business.site/ http://www.facebook.com/ChrisBJohnsonRealtor http://www.ChrisBJohnsonRealtor.com http://www.twitter.com/CBJRealtor https://www.pinterest.com/chrisbjohnsonre/ https://www.instagram.com/chrisbjohnsonrealtor/ https://search.google.com/local/posts?q=Moorpark+Short+Sale+Specialist&ludocid=5817891684567616689#lkt=LocalPoiPosts&lpstate=pid:249604486823837412&trex=m_t:lcl_akp,rc_f:nav,rc_ludocids:5817891684567616689 https://www.google.com/search?q=Chris+B+Johnson+Realtor&ludocid=5798838494712077139&_ga=2.159473401.537763112.1546635339-659962020.1513365692#lkt=LocalPoiPosts&trex=m_t:lcl_akp,rc_f:nav,rc_ludocids:5798838494712077139

The candidates I’ve been watching closely are:

The candidates I’ve been watching closely are: Home sales are weak nationwide. In California, new housing is not keeping pace with commercial and industrial development. Consequently, California has predictably ended up with less new housing and sharply higher housing values. Higher home values are currently indicative of most robust regional economies in the nation.

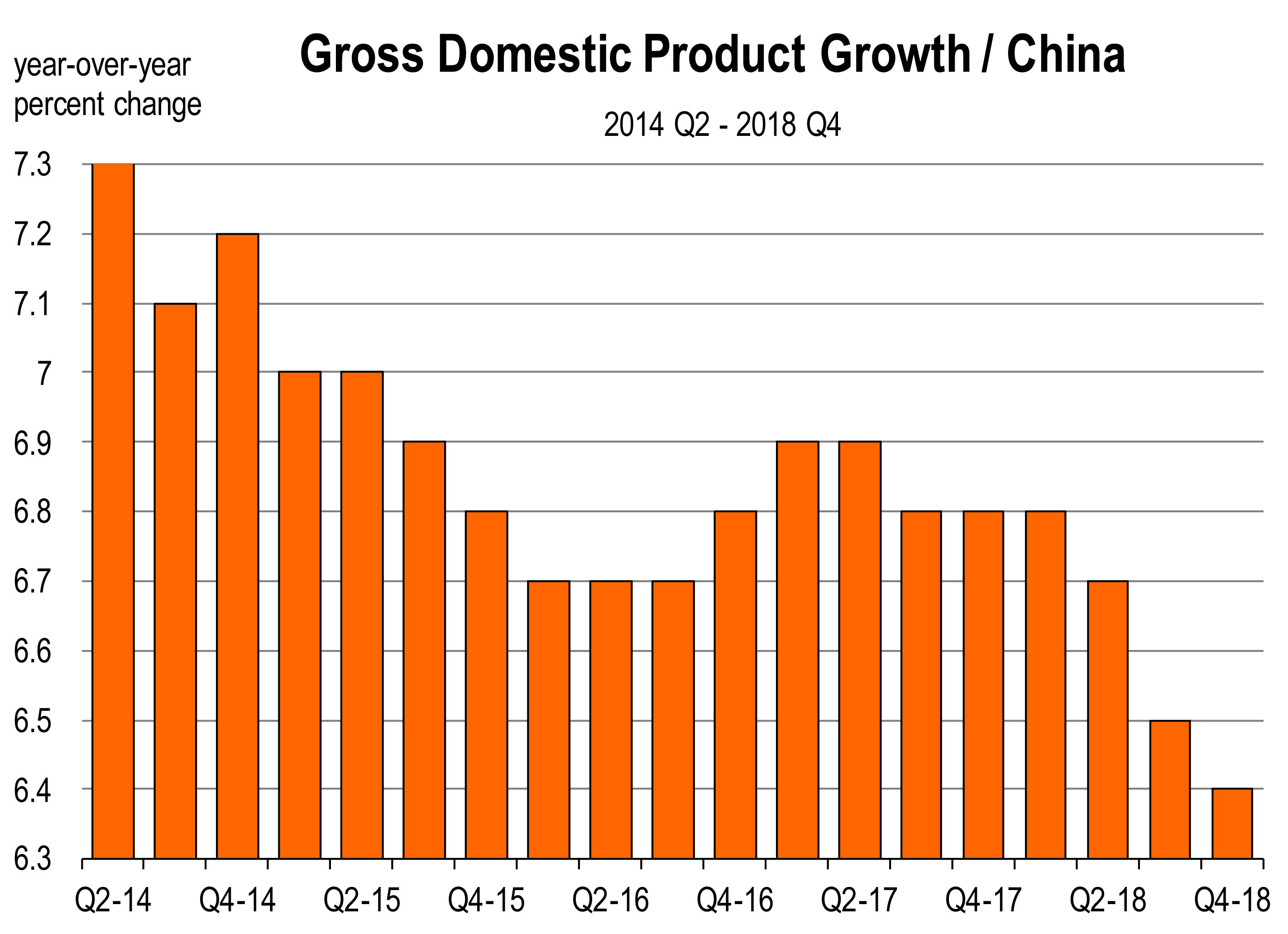

Home sales are weak nationwide. In California, new housing is not keeping pace with commercial and industrial development. Consequently, California has predictably ended up with less new housing and sharply higher housing values. Higher home values are currently indicative of most robust regional economies in the nation. The fiscal stimulus in 2018 enabled U.S. companies to shake off signs of slower growth in China, Japan, Germany and elsewhere.

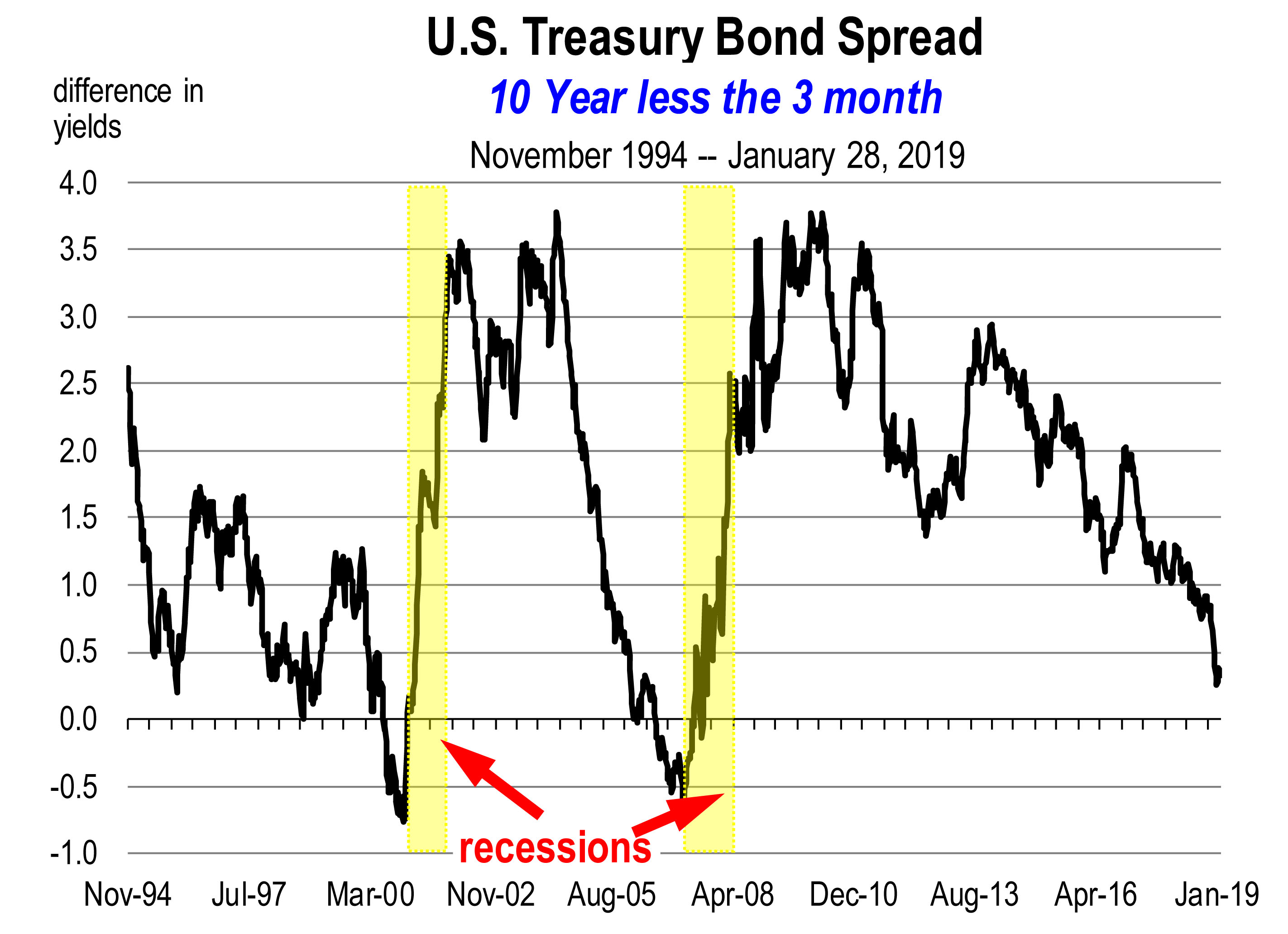

The fiscal stimulus in 2018 enabled U.S. companies to shake off signs of slower growth in China, Japan, Germany and elsewhere. The yield curve, as measured by the spread between short-dated yields and longer term bond yields, has steadily flattened towards “an inversion.”

The yield curve, as measured by the spread between short-dated yields and longer term bond yields, has steadily flattened towards “an inversion.”