BY MARK SCHNIEPP, REBLOGGED BY CHRIS B JOHNSON REALTOR®

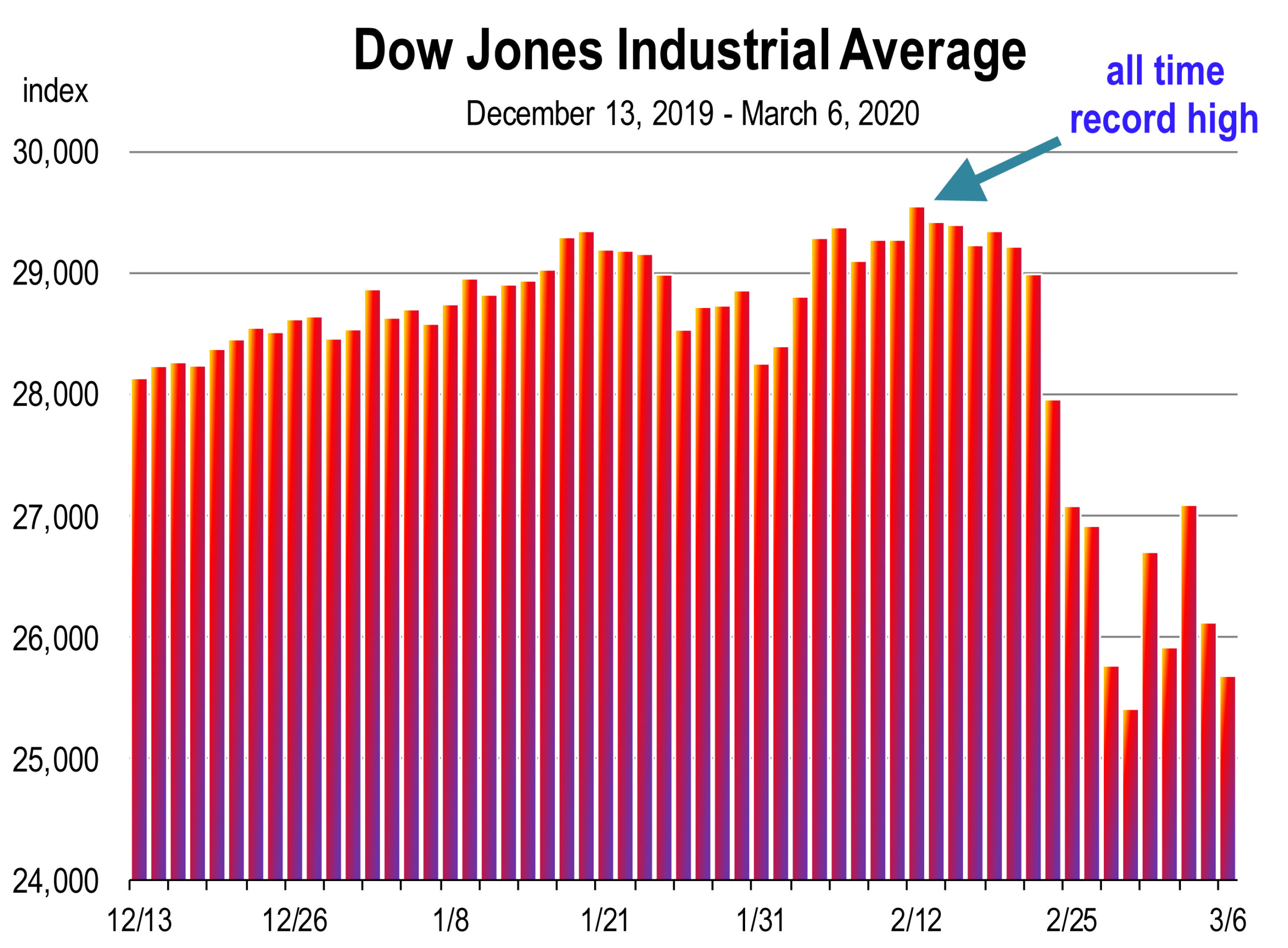

Up until mid February, there was little worry about the 6 month outlook for the U.S. economy. We were relatively certain that the expansion would continue at least that long because the seeds of a general slowdown were simply absent. Even today, job creation through February continues to impress, manufacturing is clawing back from the effects of the trade war, spending by consumers has continued and the stock market was making record high after record high going into the last week of February.

COVID-19

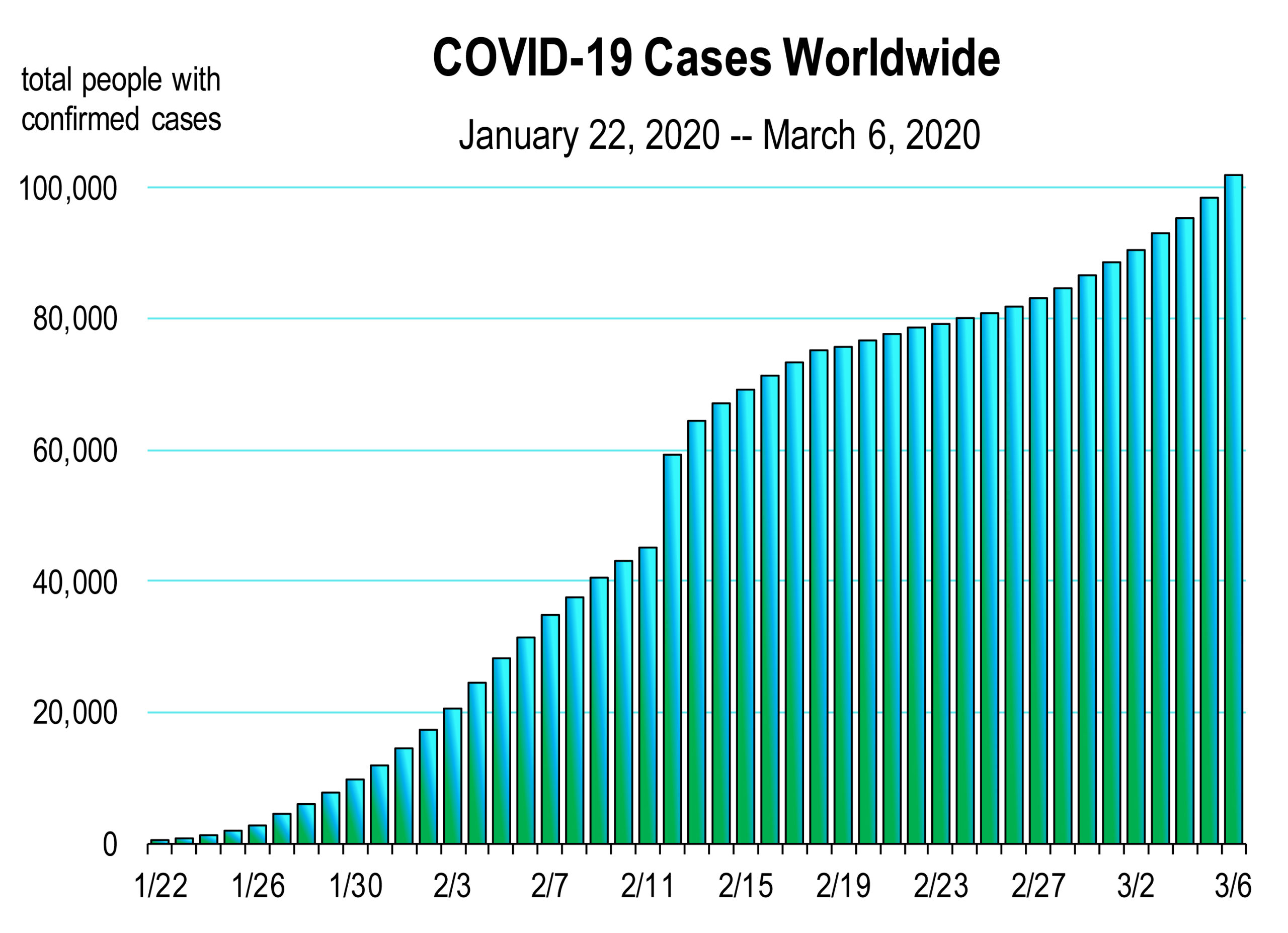

The emergence of the corona virus has been swift and substantial. Between January 22 and March 6, the number of cases globally has exploded, from less than 500 to just over 100,000. New case growth in China appears to be contained. That’s not yet the case in Italy, Iran or South Korea.

The emergence of the corona virus has been swift and substantial. Between January 22 and March 6, the number of cases globally has exploded, from less than 500 to just over 100,000. New case growth in China appears to be contained. That’s not yet the case in Italy, Iran or South Korea.

On January 30, 2020, the International Health Regulations Emergency Committee of the World Health Organization declared the outbreak a public health emergency of international concern. So it was at that time that we entered into the world of pandemic.1

Two weeks ago, the CDC reported that “the virus is NOT currently spreading in the community of the United States.2 ” However, more new cases emerging in the State of Washington and elsewhere suggest that the virus has been spreading for weeks.

The high profile reporting of the circumstances of the virus spreading globally into a pandemic has motivated rapid behavior on the part of many countries to contain it. But at the same time, the daily media reports on new case and death counts have created a hysteria in the world’s population.

This is a perfect prescription for a recession: a sudden and unexpected chaotic event that produces a massive crisis of confidence. In our year long search for the ultimate cause of the long awaited recession, could this be the catalyst for the event?

Perhaps, but in this case, the virus represents an “external shock” that is unrelated to an economy that may be evolving over time with imbalances. The impact of the virus on the economy has so far been to reduce supply and not demand. And that reduction in supply (of people and the goods they produce) is temporary and will seemingly be fully restored once the virus is contained.

Financial markets crashed the week of February 24 as the virus spread and the uncertainty of containment gripped investors. Even today, there is uncertainty and panic regarding the extent and direction of the virus. And that panic continues to impact the stock market.

If the market continues to sell off, households will perceive their wealth positions to have eroded. Along with the fear of contracting the virus, consumers will reign in their spending. They will stay home and avoid restaurants, bars, the movies and other venues of entertainment. Then the “external shock” evolves into a demand issue.

We are already suffering from lower demand by foreign visitors for travel to California and the U.S. Events are being cancelled and schools are temporarily closing. Supply chain problems for some U.S. companies are hampering production, and some layoffs are occurring. Both production and spending may therefore be meaningfully impacted unless COVID-19 is contained soon or the hysteria subsides.

U.S. Containment

The U.S. has so few cases at this time with nearly all having origins of contact traced to Asia. Containment efforts have been swift and ongoing. Cruise ships to and from China were suspended. Airline flights in and out of China were cancelled. Anyone having had contact with China was barred from entry or immediately quarantined. Hong Kong has also been removed from the flight schedule by the airline companies. The U.S. added South Korea and Italy to the screening list for all U.S. bound passengers from those countries. All Travel from Iran is banned.

Hypothetical Scenarios for COVID-19 and the Effect on the Economy

Many provinces (24) of China were shut down by February 1. Factories closed and workers were told to remain at home. These provinces accounted for more than 80 percent of national GDP and 90 percent of exports.3 An estimated 56 million people in Hubei province (the epicenter of the virus) were under lockdown for nearly a month. By February 5, millions more workers were ordered to stay indoors as a measure of China’s draconian containment effort. This produced a major supply disruption for the international economy because China is the world’s second largest economy. Google, Apple, and Tesla have shut down all operations in China.

A survey by the American Chamber of Commerce in China, released on February 27, provided the first initial response of how Chamber members have been impacted. Nearly one-third of respondents indicated they have faced increased costs and significant revenue reductions already. Their outlook in general has been negatively impacted regarding the U.S.-China relationship.4

Disruptions to world tourism have resulted from the spread of the virus. With flights and ships suspended from entering China, visitors to Shanghai, Beijing, and the Great Wall are currently non-existent. Chinese visitors to California are also non-existent. And Chinese tourism is responsible for an estimated $4 billion in annual expenditures in California.

In late February, China started to restore work. While the government is advising local decision makers in the affected provinces to take all measures possible to limit the spread of the virus, there are also instructions to gradually resume work schedules to meet economic growth targets for the year. The Country has effectively been closed down for the last 3 weeks. However, the biggest bottleneck is a “labor shortage” since many workers are quarantined for 2 weeks before being allowed to enter factories and offices.

It is still too early to determine how significant the long-term impact of the virus will be. Here are a few scenarios: best to worst case:

- By late March, the virus appears contained with no meaningful increases in infections globally. More people recover from the virus than contract it. Most of China’s factories reopen and supply chains are largely restored to businesses in China, the U.S. and elsewhere worldwide. There is a 45 to 60 day impact.

- COVID-19 remains active throughout March and into April, peaking by mid-month. Containment is achieved in late April. Economic production is mostly restored by mid-May. June is a more normal month. Economic growth in the U.S. is impacted for the February 15 to May 15 time period, or about 3 months.

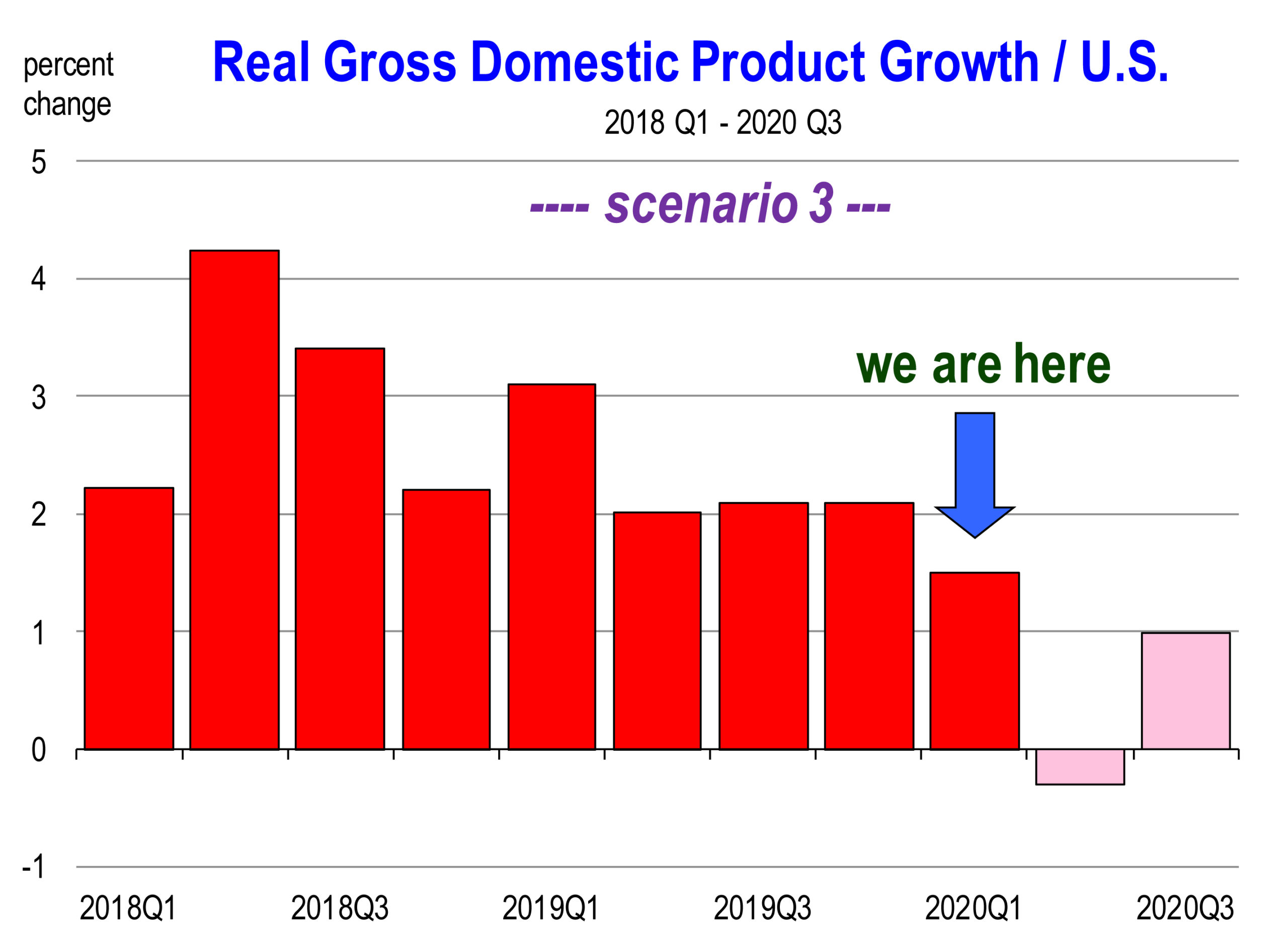

- Containment is not achieved until August 1, 2020. There are 500,000 to 1 million cases of the virus. Factories in China have all reopened by July after 5 months of either complete or partial shutdowns. Quarters 1 and 2 produce negative growth for China. In the U.S. GDP growth is impacted by up to 200 basis points. Production slowdowns or suspensions due to supply and demand issues force companies to lay off workers. Depending on intrinsic slowdowns in other sectors, this likely produces overall negative growth in Quarter 2 of 2020.

At this writing, I’d opt for scenario 2, but scenario 1 can’t yet be dismissed. We will know next week if financial markets globally will break their fall. Factories in China started opening again late last week and many people that tested positive for COVID-19 over the last month have now recovered.

Recession is a possibility for the U.S. due to COVID-19 but not a foregone conclusion. It all depends on the speed at which the virus can be contained and the current hysteria defused.

________________________

1 Coronaviruses are a large family of viruses that are common in many different species of animals, including camels, cattle, cats, and bats. The SARS-CoV-2 virus is a betacoronavirus, like MERS-CoV and SARS-CoV. All three of these viruses have their origins in bats.

No comments:

Post a Comment