Over the past year, mortgage rates have fallen more than a full percentage point. This is a great driver for homeownership, as today’s low rates provide consumers with some significant benefits. Here’s a look at three of them:

- Refinance: If you already own a home, you may want to decide if you’re going to refinance. It’s one way to lock in a lower monthly payment and save substantially over time, but it also means paying upfront closing costs too. You have to answer the question: Should I refinance my home?

- Move-up or Downsize: Another option is to consider moving into a new home, putting the equity you’ve likely gained in your current house toward a down payment on a new one that better meets your needs – something that’s truly a perfect fit for your family.

- Become a First-Time Homebuyer: There are many financial and non-financial benefits to owning a home, and the most important thing is to first decide when the time is right for you. You have to determine that on your own, but know that now is a great time to buy if you’re considering it. Just take a look at the cost of renting vs. buying

Why 2019 Was a Great Year for Homeownership

Last year at this time, mortgage rates were 4.63% (substantially higher than they are today). If you’re one who waited for a better time to make a move, market conditions have improved significantly. Today’s low mortgage rates combined with increasing wages are making homes much more affordable than they were just one year ago, so it’s a great time to get more for your money and consider a new home.

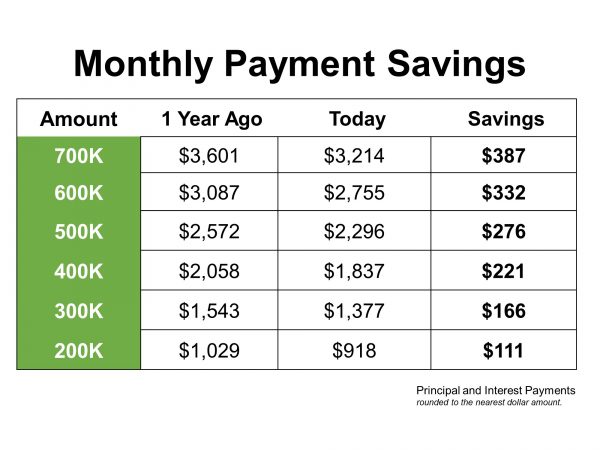

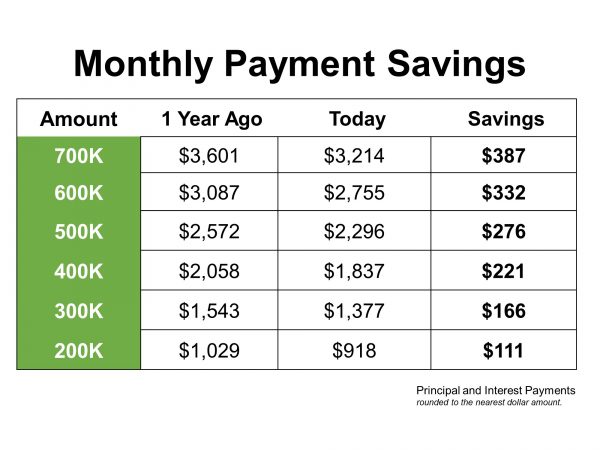

The chart below shows how much you would save based on today’s rates, compared to what you would have paid if you purchased a house exactly one year ago, depending on how much you finance.

Bottom Line

If you’ve been waiting since last year to make your move into homeownership, or to find a house that better meets your needs, today’s low mortgage rates may be just what you need to get the process going. Let’s get together to discuss how you can benefit from the current rates.

There are rumors that our Fed is considering an idea to abandon its present 2% target rate for inflation in favor of a floating target where inflation would be allowed to rise above 2% for some time before considering hiking rates.

This comes with two consequences that mortgage lenders, real estate agents and would-be borrowers need to understand.

When the Fed says they want inflation to reach its 2% target, they are talking about the Core Personal Consumption Expenditure (PCE) year-over-year figure.

The Core PCE Index is typically delivered the third week of every month, and will be even more important to track should the Fed make changes to its current policy and decide to allow inflation to rise above its longstanding 2% target.

Bottom line: inflation currently remains tepid and is the major reason why long-term rates, like home loans, remain near three-year lows. If inflation rises, home loan rates will rise. The opposite is also true.

Forecast for the Week

The upcoming week will be centered around the two-day Fed meeting which kicks off on Tuesday, and ends with the release of the Monetary Policy Statement on Wednesday at 2:00 p.m. ET. The Fed will also release a set of economic projections with the statement while Fed Chair Powell will hold a press conference at 2:30 p.m. ET.

There is a zero percent chance of a change in the short-term Fed Funds Rate at this meeting. What Mr. Powell has to say could impact bond prices and rates, but the market feels that the Fed Chair will choose his words carefully as to not overly disrupt the markets.

The week will also feature inflation data from both the Consumer Price Index (CPI) and Producer Price Index (PPI). As mentioned, the Fed has recently reported that in 2020 it may raise its target range for inflation from 2% to possibly 2.5%, which means consumer inflation readings will be more important to track. Note, the Fed’s preferred measure of consumer inflation is the Core PCE and not the CPI measure.

Consumer spending will also be in the spotlight in the form of Retail Sales for November. The consumer has been carrying the U.S. economy. We shall see if it continues, leading up to this record holiday shopping season.

Finally, the markets will continue to be gripped by the back-and-forth headlines from the U.S./China trade issues.

Reports to watch:

If you or someone you know has any questions about home loan rates, please give me a call. I’d be happy to help.

Source: Vantage

|

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

#ChrisBJohnsonREALTOR,#TopProducer,#FlipandFix,#RealEstateInvestor,#RentalProperties, #BoomerageBuyers,#MultiGenerationalBuyers,#AJIBoom,#FindYourDreamHome,#PreApproval

No comments:

Post a Comment