It’s hard to listen to today’s news without hearing about the uncertainty surrounding global markets, the spread of the coronavirus, and tensions in the Middle East, just to name a few. These concerns have caused some to question their investment plans going forward. As an example, in Vanguard’s Global Outlook for 2020, the fund explains,

“Slowing global growth and elevated uncertainty create a fragile backdrop for markets in 2020 and beyond.”

Is there a silver lining to this cloud of doubt?

Some worry this could cause concern for the U.S. housing market. The uncertainty, however, may actually mean good news for real estate.

Mark Fleming, Chief Economist at First American, discussed the situation in a recent report,

“Global events and uncertainty…impact the U.S. economy, and more specifically, the U.S. housing market…U.S. bonds, backed by the full faith and credit of the U.S. government, are widely considered the safest investments in the world. When global investors sense increased uncertainty, there is a ‘flight to safety’ in U.S. Treasury bonds, which causes their price to go up, and their yield to go down.”

Last week, in a HousingWire article, Kathleen Howley reaffirmed Fleming’s point,

“The death toll from the coronavirus already has passed Severe Acute Respiratory Syndrome, or SARS, that bruised the world’s economy in 2003…That’s making investors around the world anxious, and when they get anxious, they tend to sell off stocks and seek the safe haven of U.S. bonds. An increase in competition for bonds means investors, including the people who buy mortgage-backed bonds, have to take lower yields. That translates into lower mortgage rates.”

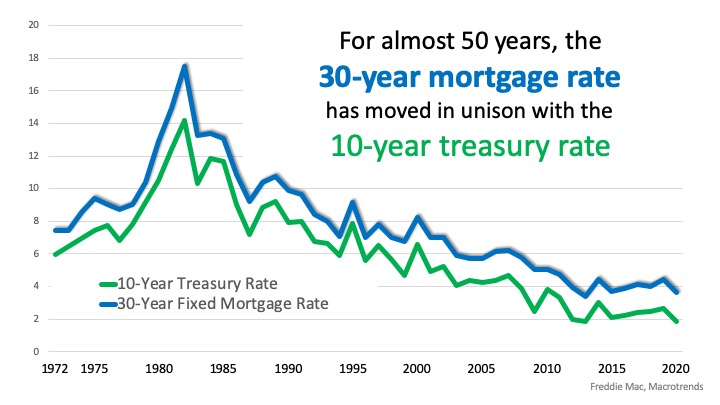

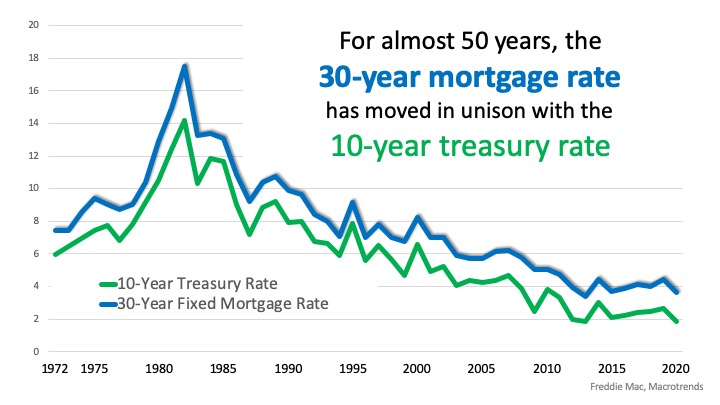

The yield from treasury bonds is the rate investors receive when they purchase the bond. Historically, when the treasury rate moves up or down, the 30-year mortgage rate follows. Here’s a powerful graph showing the relationship between the two over the last 48 years: How might concerns about global challenges impact the housing market in 2020? Fleming explains,

How might concerns about global challenges impact the housing market in 2020? Fleming explains,

How might concerns about global challenges impact the housing market in 2020? Fleming explains,

How might concerns about global challenges impact the housing market in 2020? Fleming explains,“Even a small change in the 10-year Treasury due to increased uncertainty, let’s say a slight drop to 1.6 percent, would imply a 30-year, fixed mortgage rate as low as 3.3 percent. Assuming no change in household income, that would mean a house-buying power gain of $21,000, a five percent increase.”

Bottom Line

For a multitude of reasons, 2020 could be a challenging year. It seems, however, real estate will do just fine. As Fleming concluded in his report:

“Amid uncertainty, the house-buying power of U.S. consumers can benefit significantly.”

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

- TOPIC: Home Buying

- LOCATION:

- California Ventura County

#ChrisBJohnsonREALTOR,#TopProducer,#FlipandFix,#RealEstateInvestor,#RentalProperties, #BoomerageBuyers,#MultiGenerationalBuyers,#AJIBoom,#FindYourDreamHome,#PreApproval,

#BidOnHomes, XomeAgentNetwork, XomeLuxuryAuctions,

No comments:

Post a Comment