Your home is probably the biggest asset you own. This is why you should hire a professional to guide youthrough all your real estate transactions. My goal is to help 24 to 28 families each year either buy or sell a home. I am NOT interested in Selling 100 or 200 homes a year because I would not be able to give each family the time, attention and energy they deserve......

Home sales are below last year’s levels, home values are appreciating at a slower pace, and there are reports showing purchasing demand softening. This has some thinking we may be entering a buyers’ market after sellers have had the upper hand for the past several years. Is this really happening?

The market has definitely softened. However, according to two chief economists in the industry, we are a long way from a market that totally favors the purchaser:

Dr. Svenja Gudell, Zillow Chief Economist:

“These seller challenges don’t indicate we’re suddenly in a buyers’ market – we don’t expect market conditions to shift decidedly in favor of buyers until 2020 or later. But buyers certainly are starting to balk at the rapid rise in prices and home values are starting to grow at a less frenetic pace.”

Danielle Hale, Chief Economist of realtor.com:

“The signs are pointing to a market that’s shifting toward buyers. But, in most places, we’re still a long way from a full reversal.”

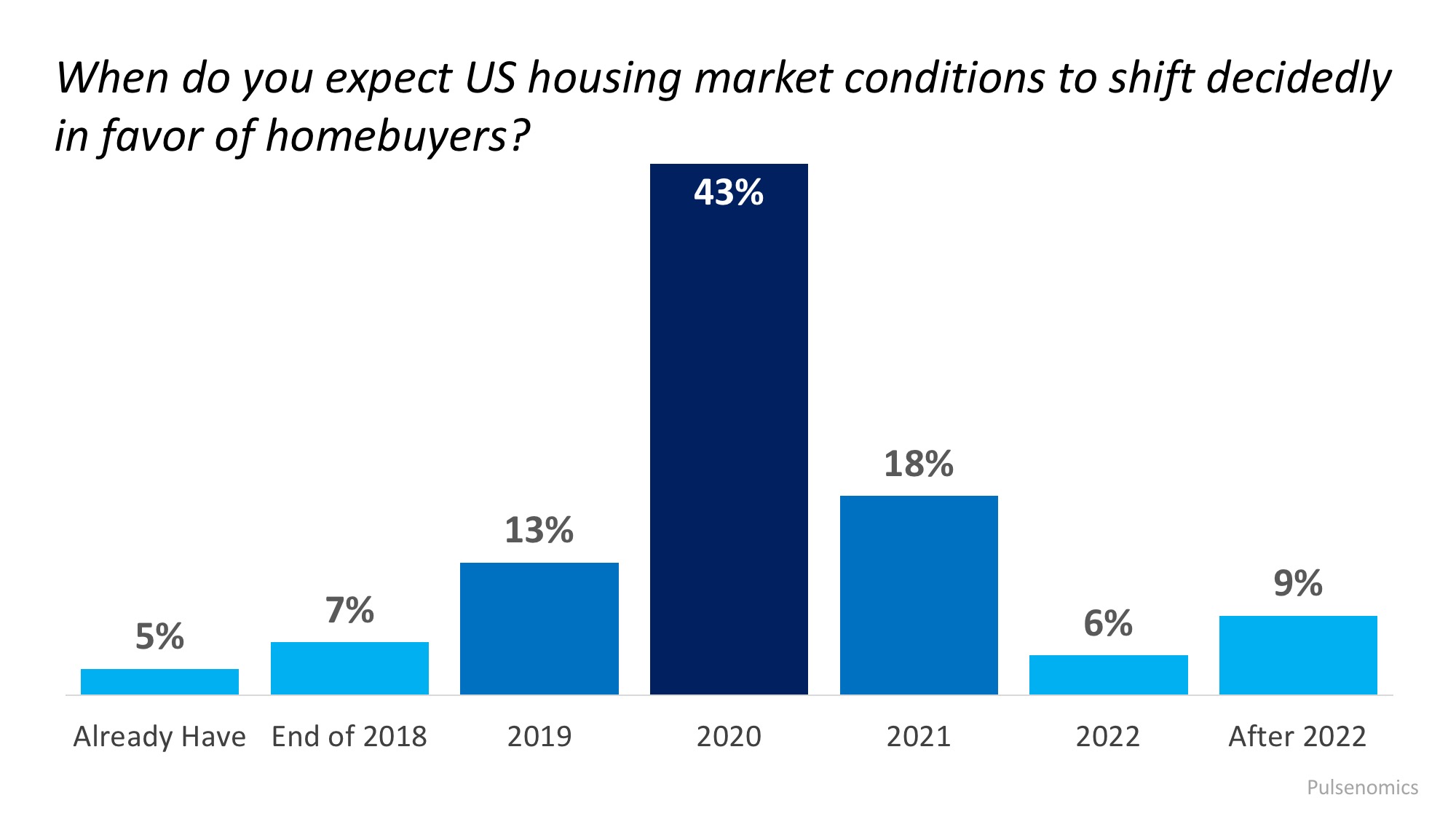

In addition, Pulsenomics Inc. recently surveyed over one hundred economists, real estate experts, and investment & market strategists and asked this question:

“When do you expect U.S. housing market conditions to shift decidedly in favor of homebuyers?”

Only 5% said the market has already shifted. Here are the rest of the survey results:

Bottom Line

The market is beginning to normalize but that doesn’t mean we will quickly shift to a market favoring the buyer. We believe Ivy Zelman, author of the well-respected ‘Z’ Report, best explained the current confusion:

“With the rate of home price appreciation starting to decelerate alongside the uptick in inventory…we expect significant debate about whether this is a bullish or bearish sign.In our view, the short-term narrative will probably be confusing, but more sustainable growth and affordability will likely be the end result.”

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

No comments:

Post a Comment