Headlines spotlight the fact that buying a home is less affordable today than it was at any other time in more than a decade. Those headlines are accurate.

Understandably, buying a home is more expensive now than immediately following one of the worst housing crashes in American history. Over the past decade, the market was flooded with distressed properties (foreclosures and short sales) selling at 10-50% discounts. There were so many that this lowered the prices of non-distressed homes in the same neighborhoods. As a result, mortgage rates were kept low to help the economy.

Prices have since recovered. Mortgage rates have increased as the economy has gained strength. This has impacted housing affordability. However, it’s necessary to give historical context to the subject of affordability.

Two weeks ago, CoreLogic reported on what they call the “typical mortgage payment”.As they explain:

“One way to measure the impact of inflation, mortgage rates and home prices on affordability over time is to use what we call the ‘typical mortgage payment.’ It’s a mortgage-rate-adjusted monthly payment based on each month’s U.S. median home sale price. It is calculated using Freddie Mac’s average rate on a 30-year fixed-rate mortgage with a 20 percent down payment…The typical mortgage payment is a good proxy for affordability because it shows the monthly amount that a borrower would have to qualify for to get a mortgage to buy the median-priced U.S. home…When adjusted for inflation, the typical mortgage payment puts homebuyers’ current costs in the proper historical context.”

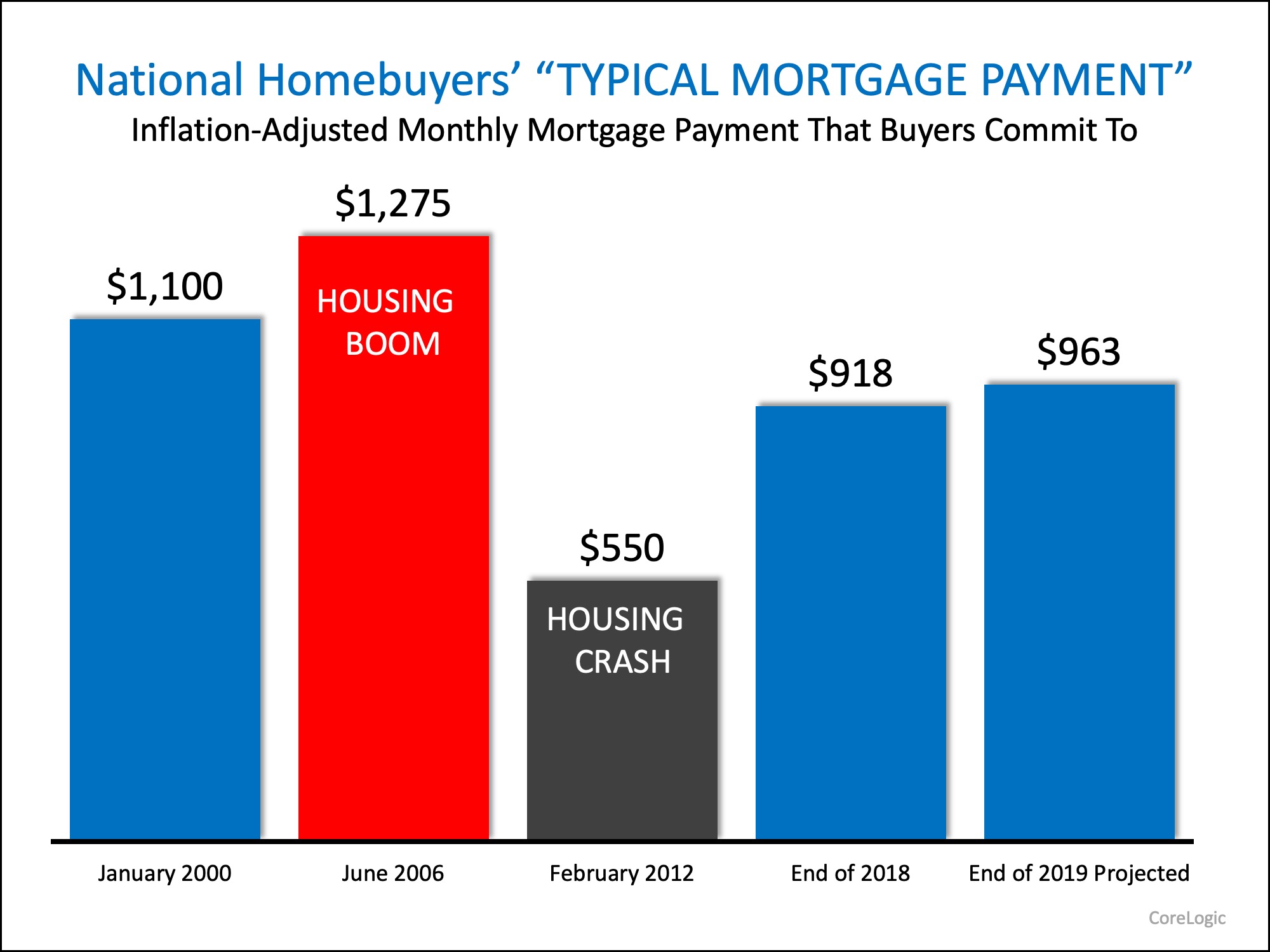

Here is a graph showing the results of CoreLogic’s research:

As the graph indicates, the most recent calculation remained 28% below the all-time peak of $1,275 in June 2006. That’s because the average mortgage rate at that time was 6.68%. As seen in the graph, both today’s typical payment and CoreLogic’sprojection for the end of the year are less than it was in January 2000.

Bottom Line

Even though home prices are appreciating at a slower rate, home affordability will likely continue to slide. However, this does not mean that buying a house is an unattainable goal in most markets. It is still less expensive today than it was prior to the housing bubble and crash.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

RateMyAgent VC 5 Star Rated Realtor ChrisBJohnsonRealtor on YouTube.

Sell Your Home For More For More and Pay Less Using A 5 Star Rated REALTOR®.

Sell Your Home For More and Pay Less

Sell For More & Pay Less #ChrisBJohnsonRealtor

. Sell For More and Pay Less-Xome Super Seller

Xome Super Seller #ChrisBJohnsonRealtor #SellForMoreAndPayLess

No comments:

Post a Comment